- A peak in the price of bitcoin would be a bearish trigger for the stock market, according to Stifel.

- The digital currency hit an all-time high of about $73,800 on March 14 and has yet to retest that level.

- "Bitcoin and NASDAQ 100 reflect the speculative fever fostered by cheap money after dovish Fed pivots," strategist Barry Bannister said.

A peak in the price of bitcoin would be a bearish trigger for the broader stock market, according to a Wednesday note from Stifel equity strategist Barry Bannister.

Bitcoin hit an all-time high of about $73,800 on March 14 and has yet to retest that level. The world's largest cryptocurrency traded at about $67,600 on Thursday.

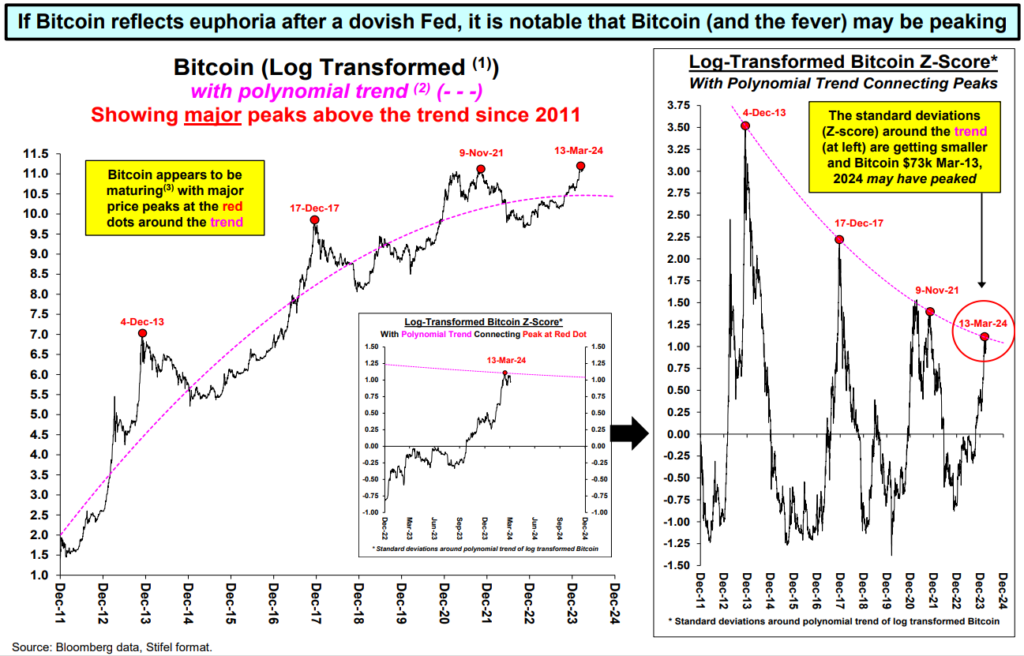

Bannister argued that the recent surge in bitcoin coincides with a dovish pivot from the Federal Reserve, but that linkage could signal an end to the current bull run.

"Bitcoin & NASDAQ 100 reflect the speculative fever fostered by cheap money after dovish Fed pivots, such as occurred 4Q 2023. We show that if Bitcoin reflects euphoria after a dovish Fed, it is notable that Bitcoin (and the fever) may be peaking," Bannister said.

Bannister pointed to a log chart of bitcoin with a polynomial trend applied, which shows that bitcoin "appears to be maturing with major price peaks" at around the $73,000 level.

And if bitcoin did indeed peak, the implications are negative for the broader stock market, especially mega-cap tech stocks and the Nasdaq 100 over the next six months, according to Bannister.

A peak in bitcoin means "weaker" mega-cap tech stocks, a likely pull-back in investor sentiment, and the S&P 500 would underperform the equal-weighted S&P 500 over the next six months. That sets up for value stocks to finally start outperforming growth stocks, according to the note.

The big catalyst for a downturn in risk assets would be a reversal in the Fed's dovish pivot from late last year. That could be sparked by either strong economic growth or clear signs that inflation is still rising. In other words, the Fed's pivot that has helped boost stocks and crypto so far this year may be all bark with no bite.

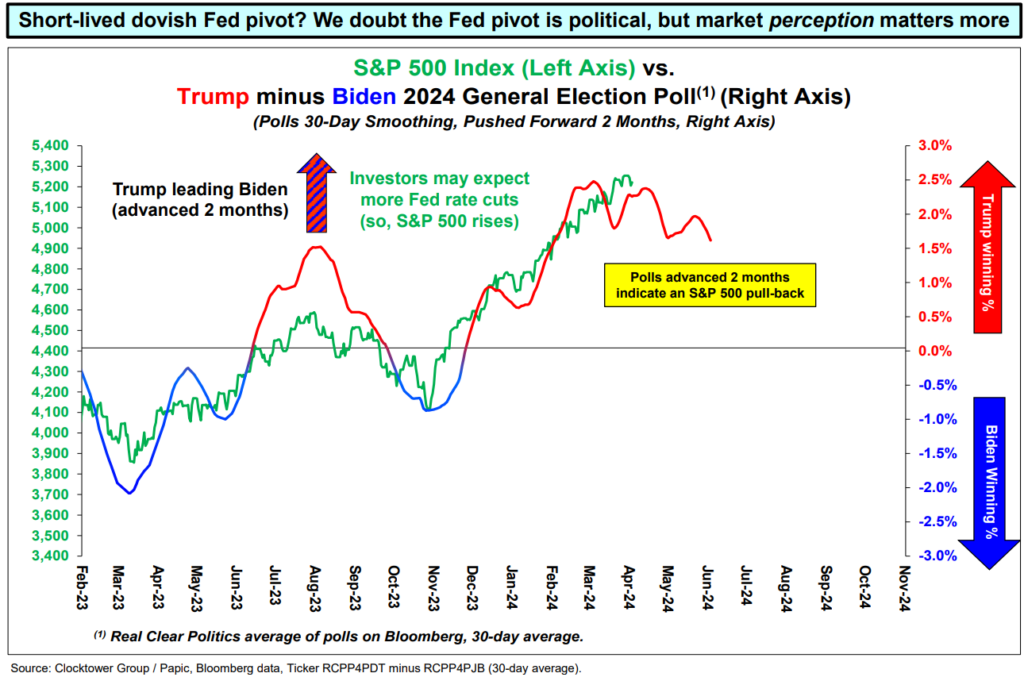

"Without clear signs underpinning the Fed bullish shift in 4Q23, the market may have adopted a political interpretation. While we doubt the Fed pivot was political, it is investors' perception which matters more, and using that logic we show that recent poll differentials also support a pull-back for major equity indices," Bannister said.